nest higher risk fund

Fourty seven per cent of NEST members are female 53 are male. You switch funds by going online and transferring the funds.

Nest Stays Cautious Despite Positive 2019 Returns News Ipe

Nest higher risk fund.

. 1 Year change --. Find out where Nests funds are invested. The default fund we are placed into returned just 492 in 5 years. Fund overview The Higher Risk Fund is for members who are more confident about taking investment risk in the expectation that their pot will grow faster.

How does the fund work. Finden Sie heraus was die staatliche Rente ist wie Sie sich qualifizieren und beobachten Sie die Erfahrungen realer Menschen die die staatliche Rente in Anspruch nehmen. The combination of UK direct and global indirect funds offers higher diversification and liquidity and simultaneously reduces fund expenses and the entry and exit costs. The two new funds represent the ninth and tenth underlying building blocks that are used for NEST Retirement Date Funds and NEST fund choices.

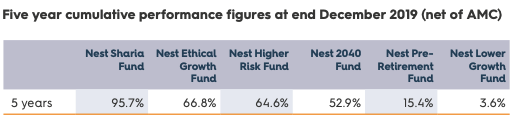

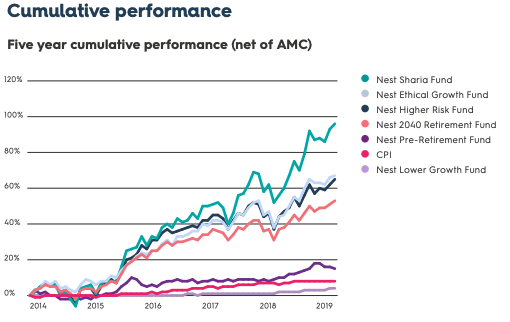

Members with a greater risk appetite invested in the NEST Higher Risk Fund saw returns of 156 only 11 percentage points above the Sharia-compliant fund. Meanwhile the 2040 fund for older savers which takes more risk has made 108 per cent since launch and 22 per cent over the past year. The Nest 2040 Retirement Date Fund has achieved an investment return of 46. You can also choose to invest in other funds including ethical Sharia Law and high-risk funds.

The Nest Higher Risk Fund is designed for members who are prepared to take more investment risk to try and make their retirement pot grow more. You could transfer a small amount from your current pot into a higher risk fund but keep contributing to the default one and see how both react over the next couple years. Todays Change -0016 -052. NEST does provide alternative options for those who want to take on more risk but even its higher risk fund targets a portfolio that is 70 per cent equities.

The Retirement Date Fund aims to target investment returns in excess of inflation after all charges over the long term. See the full results for all NEST funds below. Nest Lower Growth Fund. From the NEST dashboard I can access a single fact sheet dated June 2013 which gives a breakdown shareholdings volatility levels past performance 179 in the previous year 99.

- Diversification is the key tool for managing risk. Lots of businesses opt for Nest to help their employees build a pension fund instead of setting up their own pension schemes. The funds are as follows. If your employer offers Nest youll be enrolled.

Die Rentenfreiheiten im Jahr 2015. However the figure for its higher risk fund is. The strategy reduces risk as members approach retirement by automatically moving their pot into the appropriate NEST Retirement Date Fund when theyre 10 years from their planned retirement date. NEST fund building blocks are all blended by.

For the record NESTs investment beliefs include. The Nest Retirement Date Fund is the one that most members stick with which works by enrolling members into the fund that targets the year they expect to take their money out of Nest. With NEST pensions the fund your money is paid into is based on your estimated date of retirement. The fund aims to grow retirement pots by investing more in higher risk investments.

But then you need to lop off Nests charges amounting to 127 in this case. Nest Retirement Date Fund. As part of auto-enrolment I have been signed up to NEST by my employers and am having issues finding out more information regarding the various funds on offer particularly the Higher Risk Fund. Continue with higher risk until retirement.

NEST Higher Risk Fund. The only option that is 100 per cent equities is the Sharia fund which also happens to be the fund thats performed best since inception. Or leave the current pot as is and split new contributions between it and the higher risk one I presume as Im not that familiar with NEST 0. Data delayed at least 60 minutes as of Dec 02 2021.

NEST Higher Risk Fund Pension. NEST has also significantly rebalanced its asset allocation. Nest pre-retirement fund Only available to those approaching retirement. To make it easier to understand where Nests funds are invested and how were delivering each fund we publish a report every quarter.

Nest also offers additional fund choices. It works like any other workplace pension scheme with contributions both from you and from your employer and tax relief on all the contributions you make. Nest lower growth fund. NEST managed 95bn 103bn on behalf of 91 million members and 803000 employers compared to 57bn 79 million members and 720000 employers for the same time last year.

In 5 years Sharia grew by 966 compared to 606 in the High Risk fund. NEST retirement funds appropriate choice Moving beyond the default strategy - the DWP guidance is specific about the need for there to be options beyond the default. Nest has seven funds to choose from two of which are reserved for those that are close to retirement. Those who opted for the lower-risk fund only saw returns of 04 in line with the options benchmark return both last year and since the funds inception.

That gives you 5924. It is explained that The NEST Retirement Date Fund gradually moves my money out of higher-risk investments as I approach retirement. Nest retirement date fund. View our latest quarterly investment report PDF.

Employers and providers will be keen to avoid accusations of. Nest Higher Risk Fund. These are called Retirement Date Funds and each one is tailored to maximise your pension for the year you retire. Nest Guided Retirement Fund.

This means that I could potentially miss out on any big rises but it is also explained that this strategy is less likely to lose whatever money I will have built up. - Taking investment risk is usually rewarded in the long term. Sharia returned 326 in a year compared to 172 in the High Risk. The latest fund information for NEST Higher Risk Pn including fund prices fund performance ratings analysis asset allocation ratios fund manager information.

Nest Stays Cautious Despite Positive 2019 Returns News Ipe

Nest Higher Risk Fund Performance Nest Pensions

How To Turn 298 Per Month Into A 1 Million Nest Egg

Post a Comment for "nest higher risk fund"